The economic impact of the Covid-19 pandemic has been devasting to the global economy. During most recessions the more typical or normal behaviour is for consumers to cut spending on discretionary items including technology goods and for businesses to delay investment in new PCs, equipment, to conserve cash and wait for capacity utilisation to recover.

However, in the Covid-19 recession, we are witnessing new norms, including lockdowns, work-from-home, and remote education, which all contribute to a spike in technology spending. In comparison, we are seeing the largest reductions in real GDP come from declines in services (travel and entertainment, discretionary activities).

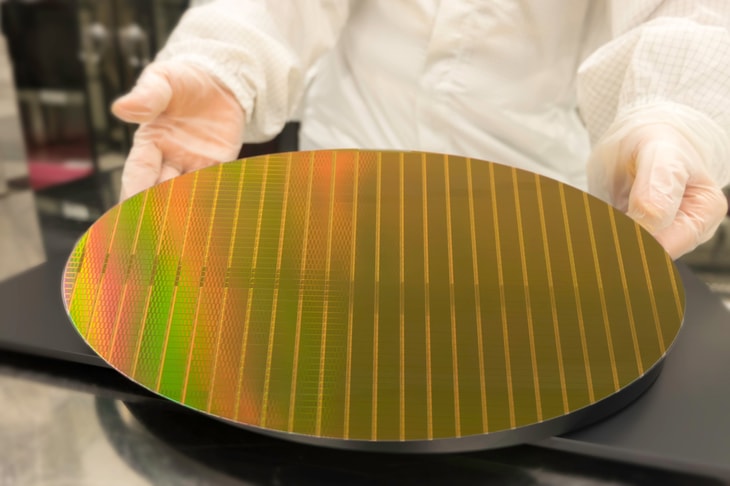

The growth in technology spending is driven by virtual connectivity. This has been essential in the era of Covid-19 as it is facilitating continuity for our everyday existence during pandemic. From this expanding use of virtual interactions for daily needs such as education, business continuity, government operations, ordering food, and socialisation there has been a growing cognisance that semiconductor technology is a key enabler for connecting people during this time of restricted travelling and social distancing.

... to continue reading you must be subscribed